"Replacement" of Electric Speed-up Charging Pile

Editor's Note: At present, with the continuous implementation of more stringent emission policies by major governments, the sales volume of automobile industry may have entered a downward channel before the COVID-19 epidemic, and the epidemic crisis may become a catalyst for this development trend. In a period full of high uncertainty, vehicle manufacturers and suppliers need to ensure their short-term liquidity in order to survive. However, the necessary structural transformation will occur in time. Recently, Roland Berger Management Consulting Company released the seventh issue of Subversive Data Detection of Automobile Industry. This paper analyzes the latest related market trends of the global automobile industry's subversive changes, and provides support and guidance for the automobile industry's decision-making in the subversive change environment. The abstract of this newspaper is published for readers.

According to the report "Subversive Data Detection in Automobile Industry", the global overall score has increased significantly in the past three years. Thanks to consumers' high acceptance of new energy vehicles and digital applications, the promotion of new energy supply by policies, and the great progress in infrastructure and autonomous driving road test, China's overall score still maintains a global leading position, but it is at its peak (The first half of 2019) has fallen back; Due to the substantial increase in the sales volume of new energy vehicles and the continuous expansion of the layout of electric piles, the autonomous driving road test regulations have progressed rapidly, and the Netherlands has jumped up and tied for first place with China; Britain, South Korea, Sweden and other top-ranked countries are getting higher overall scores, and the gap with China is gradually narrowing.

Electric cars are more popular

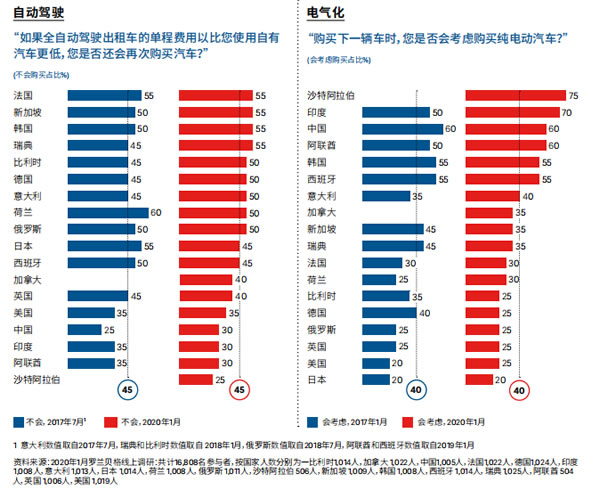

The sixth issue of "Subversive Data Detection of Automobile Industry" found that despite the overall downturn of the automobile industry, consumers' interest in electric vehicles and self-driving vehicles is still increasing. According to the seventh report, this interest has been maintained at a high level all over the world, with 55% of respondents accepting the service of self-driving taxis, and 40% of consumers considering buying electric vehicles as the next car.

Compared with the sixth report, the sales growth of pure electric vehicles and plug-in hybrid vehicles has slowed down. The sales volume of 18 countries surveyed in 2019 and 2018 was 2.1 million and 1.9 million respectively, with an annual growth rate of 10.5%. In contrast, despite the stagnation of global automobile sales, in order to achieve the goal of reducing carbon emissions, electric vehicle sales still need to achieve double-digit annual growth rate. At present, more than 340 pure electric and plug-in hybrid models have been sold in 18 countries in the report of Subversive Data Detection of Automobile Industry, which is a significant increase compared with the 125 models in the first report of 2016.

In China, where the absolute value of sales of new energy vehicles ranks first in the world (with a total sales volume of 1.21 million vehicles in 2019), consumers' acceptance of new energy vehicles remains stable. Despite the impact of the COVID-19 outbreak, the demand was suppressed in the short term, and the overall sales volume of new energy vehicles in China dropped by 43% year-on-year from January to April 2020. However, with the continuation of subsidies, local governments introduced consumption stimulus policies one after another, and the sales volume of new energy vehicles will gradually rebound in the second half of the year. On the whole, China's new energy vehicle market has just entered a new period of transformation from supply and policy to demand, with the growth slowing down and the structure gradually optimized. However, affected by the global epidemic, this transformation cycle is expected to be lengthened.

Countries increase restrictions on fuel vehicles

As we have observed in the sixth report, the relevant legal framework of autonomous vehicles is still improving continuously. For example, Russia drafted a road safety regulatory framework involving autonomous driving, which will be finalized in September 2021. In the sixth report, we reported that South Korea is developing a road map for the approval of self-driving cars. Since then, the Ministry of Land, Infrastructure and Transport of Korea has issued a set of brand-new road safety standards for L3-level self-driving cars, allowing vehicle manufacturers to manufacture and sell L3-level self-driving cars from July 2020.

The test of self-driving vehicles is becoming more and more common. Among the 18 countries analyzed in this report, 15 countries have special test areas for autonomous vehicles (only Saudi Arabia, United Arab Emirates and India have not). Some countries' regulations go even further, allowing self-driving vehicles to be tested in public streets and city centers, such as Berlin, Germany. In China, the autonomous driving road test regulations have made remarkable progress since 2017. The number of test sites (24), the scale of provinces and cities (14) and the degree of opening of test roads (from closed to open) have been greatly improved. At present, the autonomous driving road test on open roads has landed in Shanghai, Changsha, Chongqing, Shenzhen and other cities.

In addition, the restrictions on traditional gasoline and diesel vehicles in cities are increasing, which further promotes the application of pure electric vehicles and plug-in hybrid vehicles. Among the 245 cities analyzed in this report, 145 cities have no explicit restrictions on fuel vehicles (compared with 191 cities in January 2017), 89 cities have slight restrictions, and 11 cities have substantial restrictions (the latter two data have increased compared with 52 and 2 cities in January 2017). However, no city has completely banned fuel vehicles. Contrary to the general trend, some cities in China (Wuhan, Foshan, Ningbo, Tangshan, Hefei) have relaxed or even lifted the restrictions due to the reduction of pollution. However, from the perspective of supply-side policy, after the adjustment of China's "double points" policy in the second half of 2019, the policy has become more stringent in developing new energy vehicles and promoting energy conservation and emission reduction, which has continuously guided vehicle manufacturers to increase the supply of new energy vehicle products. However, in 2020, the subsidy policy has improved technical indicators (such as mileage requirements, power consumption, etc.), and forced OEMs to continuously upgrade their products.

In the future, whether the restriction of fuel vehicles will continue to be used as a short-term means to solve urban emission pollution or a long-term method to guide consumers to switch to less polluting electric vehicles will be an interesting topic worth observing.

Investment in mobile travel is cautious

As mentioned in previous reports, venture capital in artificial intelligence is a key driving factor for autonomous driving. The scale of investment in this field increased from US$ 5.8 billion in 2018 to US$ 7.7 billion in 2019, an increase of more than 32%, and it seems that it has not yet reached its peak. The large-scale investment in 2019 includes $2.6 billion invested in Argo AI, a non-profit artificial intelligence research company Open AI, and a major investment in Megvii, an independent research and development laboratory focusing on artificial intelligence.

Investment in mobile travel is less optimistic. Its investment scale in 2019 was US$ 9.27 billion, 32% less than that in 2018 and more than US$ 10 billion less than the historical peak of 2017 (US$ 21.4 billion). This may be attributed to the fact that these business models hardly actually generate profits despite the hype of the new concept of travel in recent years.

Investment in mobile travel is less optimistic. Its investment scale in 2019 was US$ 9.27 billion, 32% less than that in 2018 and more than US$ 10 billion less than the historical peak of 2017 (US$ 21.4 billion). This may be attributed to the fact that these business models hardly actually generate profits despite the hype of the new concept of travel in recent years.

As in previous reports, the patent and R&D capability of the automobile industry continued to develop. According to data collected by LinkedIn, more than 100,000 employees are now active in the field of travel or autonomous driving. In addition, the number of patents related to autonomous driving increased again in 2019, accounting for 4.5% of all patents studied in this report (2.3% in 2017).

The density of charging stations has increased significantly

In the sixth report, we noticed the lack of charging infrastructure around the world. Things have improved since then: charging infrastructure is one of the fastest growing indicators in our research. By the end of 2019, there were more than 1.7 charging stations per 100 kilometers, and the overall network density is now three times that of 2017. Holland keeps leading in charging pile layout, while China and South Korea have made great progress. At the same time, Germany and other European countries are developing gradually. This general trend is expected to continue.

In China, the number of charging piles per 100 kilometers has increased from 1.6 in 2017 to 5.4 in 2020. Beijing, Shanghai and other provinces and cities have updated charging infrastructure management and subsidy policies in 2020, paying more attention to charging station operations and promoting charging. Interconnection of facilities; In addition to the traditional charging piles/stations, the policy encourages the new business model of "electricity exchange". In China's latest financial subsidy policy in 2020, the subsidy for new energy vehicles in "electricity exchange mode" is not limited by the threshold of selling price of 300,000 yuan or less.

At the same time, vehicle-to-vehicle interconnection equipment continues to be popular. With the expansion of Volvo and Mercedes-Benz models to other regions, the technology of vehicle-vehicle interconnection has been applied in 8 of the 18 countries investigated in this report. But so far, Toyota models are only sold in Japan. Volkswagen has launched a golf with the function of linking everything with the car in the US market.

On the whole, the technology of automobile industry is making continuous progress. In December, 2019, Qatar Investment Authority (QIA) and Volkswagen announced a groundbreaking plan for autonomous driving and electric transportation, aiming to help Qatar's urban transportation transformation. In January 2020, Cruise, a subsidiary of General Motors, demonstrated the first driverless car without steering wheel and pedals. However, it remains to be seen whether vehicle manufacturers will continue to promote the commercialization of new technologies or focus on their current core business. (Source: New Energy Vehicle News)

LATEST NEWS

- Xi Jinping sent a congratulatory letter to the 2019 World New Energy Vehicle Conference 2020-11-24 17:42:36

- Prospect of charging pile construction under new infrastructure 2020-11-24 17:40:17

- "Replacement" of Electric Speed-up Charging Pile 2020-11-24 17:27:20

- Why is the future charging pile market of new energy vehicles predicted to be a "bull market"? 2020-11-24 17:21:50

- Promote the construction of charging pile facilities "three axes" 2020-11-24 17:18:05

- To activate the rural new energy automobile market, we must solve the "mileage anxiety" 2020-11-24 17:14:00

Hangzhou guokong electric power technology co., ltd Service hotline: 0571-81969856 / 0571-87973887Company address: 3/F, Building 1, Qianjiang Pentium Science and Technology Park, No.16 Xiyuan First Road, Xihu District, Hangzhou