Prospect of charging pile construction under new infrastructure

By April 2020, the number of public charging piles has exceeded 540,000. China's charging market is far ahead of other countries and regions in the world.

First, the domestic charging infrastructure policy analysis

In order to speed up the promotion and construction of domestic charging infrastructure, standardize the healthy development of the industry and better support the promotion of new energy vehicles, relevant departments have gradually introduced a series of policies.

Table 1 covers the policy summary of electric vehicle charging facilities

In order to strengthen the planning guidance, "Guidelines for the Development of Electric Vehicle Charging Infrastructure (2015 ~ 2020)" puts forward the development goal of China's charging infrastructure. By 2020, more than 12,000 centralized charging and replacing power stations and 4.8 million decentralized charging piles will be added to meet the charging needs of 5 million electric vehicles nationwide. The whole country is divided into three regions: accelerated development region, demonstration and promotion region and active promotion region, and the goal of sub-regional construction is clearly defined. It also requires that "100% charging infrastructure or installation conditions should be set aside for newly built residential parking spaces, the proportion of parking spaces with charging infrastructure or installation conditions set aside for large public buildings and public parking lots should be no less than 10%, and at least one public charging station should be set up for every 2,000 electric vehicles".

It can be seen that the overall expectation of formulating the policy is that the ratio of electric vehicles to charging piles will reach 1:1, and there will be a certain number of centralized charging and replacing power stations to improve the charging service.

Figure 1 National charging infrastructure sub-regional construction goals during the 13 th Five-Year Plan period

Figure 1 National charging infrastructure sub-regional construction goals during the 13 th Five-Year Plan period

From the structure, electric vehicles can be divided into pure electric vehicles and hybrid electric vehicles. Among them, pure electric vehicles (non-replacement mode) are highly dependent on charging piles, and their entire life cycle mainly completes energy supply through charging piles; In comparison, hybrid electric vehicles have low dependence on charging piles, which can be divided into plug-in hybrid electric vehicles (PHEV) and non-plug-in hybrid electric vehicles (MHEV). MHEV does not supply energy through charging piles at all, while PHEV only supplies energy through charging piles in a few cases. From the technical principle analysis, it can be found that not all electric vehicles need charging piles to serve.

Electric vehicles can be divided into commercial vehicles and passenger cars, and their charging scenarios are different. Among commercial vehicles, pure electric commercial vehicles are absolutely dominant, which can be divided into pure electric buses, pure electric buses, pure electric trucks and pure electric sanitation vehicles. Commercial vehicles are generally used frequently, and there is a stronger demand for charging piles. Energy supply is mainly accomplished by public charging piles and special charging piles. There are two situations in passenger cars: personal use and commercial operation. Among them, personal use passenger cars have a relatively fixed journey because of their low use intensity. If private charging piles can be built with the car, they can basically pass the lower charging power. The private charging piles complete daily charging and complete emergency charging through public charging piles; Passenger cars used in commercial operation have high use intensity and unfixed journey. Although the private charging piles built with the vehicles can supply energy to a certain extent every day, the demand for public or special charging piles is still strong. Among passenger cars, pure electric passenger cars account for more than 80%, and a large proportion of them are put into use as shared cars and electric vehicles for network vehicles.

Combined with the feedback from industry enterprises, various types of electric vehicles have different demands for DC charging piles in public charging piles (including public and special ones). The demand ratio of pure electric buses and pure electric buses for DC charging piles is about 5:1, and that of pure electric logistics vehicles and pure electric sanitation vehicles is about 7:1. The demand ratio of DC charging piles for new energy passenger cars is about 20:1. Because the charging power of AC charging piles is generally low and the charging rate is slow, it is predicted that the public AC charging piles will be mainly arranged in Shangchao parking lot, residential parking lot and various decentralized parking lots in the future, and will also be built with DC charging piles. The public AC charging pile mainly builds a public charging network together with the DC charging pile in an auxiliary capacity. From the analysis of monthly possession and monthly increment of AC and DC charging piles in public charging piles in recent year, it can be found that the ratio is 6:4, which is expected to remain at this ratio for a long time in the future. However, it is difficult for private charging piles to achieve the ratio of electric vehicles to charging piles of 1:1.

To sum up, the ratio of electric vehicles to charging piles will not be maintained at 1:1 in the future.

Second, the development status of charging piles in China

1. Overall development in recent five years

From 2015 to 2019, the number of public charging piles in China continued to increase. At the end of 2019, the number of public charging piles in China reached 516,000, nearly nine times that at the end of 2015. By April 2020, the number of public charging piles has exceeded 540,000. China's charging market is far ahead of other countries and regions in the world.

In 2016 and 2017, the number of new public charging piles will remain at about 91,000. In 2018, the increment increased by 147,300 units, but slowed down in 2019, with 128,900 new public charging piles. The direct reason for the slowdown is that the sales data of new energy vehicles are lower than expected, and the main reason is that the utilization rate of charging piles remains at a low level for a long time, which reduces the enthusiasm of operating enterprises to a certain extent.

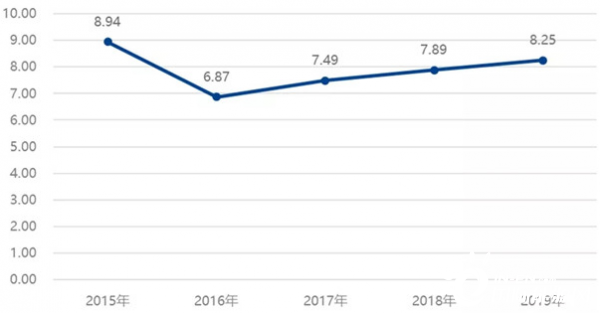

Figure 2 Changes in the ratio of total sales of new energy vehicles to the number of public charging piles from 2015 to 2019

Figure 2 Changes in the ratio of total sales of new energy vehicles to the number of public charging piles from 2015 to 2019

Figure 3 Changes in the ratio of new energy vehicle increment to public charging pile increment from 2015 to 2019

Figure 3 Changes in the ratio of new energy vehicle increment to public charging pile increment from 2015 to 2019

From 2015 to 2019, the ratio of total sales volume of new energy vehicles to the number of public charging piles remained around 8, and the ratio increased slowly after 2016. The ratio of the increment of new energy vehicles to the increment of public charging piles in 2016 is 5.55. It remained at 8.5 in 2017 and 2018, and rose to 9.36 in 2019. With the maturity of the charging market, the operating enterprises have abandoned the staking operation and started to adopt the strategy of developing according to needs and taking the lead appropriately, and the ratio of vehicle-pile increment is increasing.

2. Regional distribution status of public charging piles

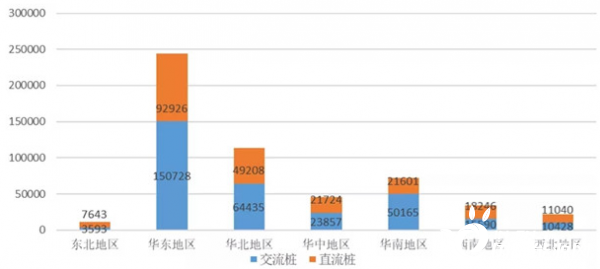

Distribution of public AC and DC charging piles in Northeast China, East China, North China, Central China, South China, Southwest China and Northwest China (see Figure 4).

Fig. 4 Distribution of the number of public AC and DC charging piles in each region

Fig. 4 Distribution of the number of public AC and DC charging piles in each region

East China is the first of the seven regions in terms of the total number of public communication piles, public DC piles and public charging piles, and the proportion of public communication piles is slightly higher; Followed by North China and South China, Central China and Southwest China also have a certain number of public AC piles and public DC piles. Due to the sparse population and low car ownership in northwest China, the number of public AC piles and public DC piles is small; The low temperature in Northeast China is not conducive to the promotion of electric vehicles, which leads to the lowest number of public AC piles and public DC piles in this area.

Nearly half of the public charging piles are distributed in East China, with a total number of more than 240,000 units. North China and South China account for 21%, 13% and 114,000 and 72,000 respectively. The number of public charging piles in these three regions reaches 430,000, accounting for nearly 80%. There are 46,000 in Central China and 34,000 in Southwest China. Northwest China and Northeast China account for only 4% and 2%.

3. The scale and market share of each charging operation enterprise

By March 2020, there were 24 charging operation enterprises (operating more than 1,000 sets) in China, which operated 538,554 public charging piles, accounting for 99.42%.

Figure 5 Large-scale charging operation enterprises-number of operating charging piles

The top ten charging operators in China have operated 497,760 sets, accounting for 91.89%. Three operators, special call, Star Charging and State Grid, are in the first echelon, operating 371,732 charging piles, accounting for 68.63%. Head operators are in the dominant position in the absolute market, and are the main service providers for charging new energy owners. However, it can be seen that China's charging operation industry is still in the stage of blooming, and there are many operating enterprises that have begun to take shape, so it is necessary to pay close attention to the interconnection between charging operation enterprises and improve the overall service level of the charging industry.

3. Thoughts and suggestions on the construction situation of charging piles under the new infrastructure

1. Problems in the development of charging piles

After years of development, many problems have been solved to varying degrees in the electric vehicle charging infrastructure industry. However, there are still some problems.

From the development of charging piles in various regions in recent years, there are obvious differences among accelerating development areas, demonstrating and promoting areas and actively promoting areas. The proportion of planning and construction targets in the three regions is 52.08% in accelerated development areas, 45.83% in demonstration and promotion areas and 2.08% in active promotion areas. According to the statistics of China Charging Alliance in April, 2020, 75.33% of the developed areas, 22.82% of the demonstration and promotion areas, and 1.24% of the active promotion areas. There are more charging piles distributed in the accelerated development areas covering the eastern coastal provinces, and there are fewer charging piles in the demonstration and promotion areas and active promotion areas, which are not only far below the target number, but also far below the target proportion. The enthusiasm of charging pile operators to lay out public charging piles is mainly determined by the demand of local electric vehicles for charging piles, which is also the main reason for the difference in the number of public charging piles among the three regions.

After collecting the willingness of different types of electric vehicle owners to build private charging piles, it is found that compared with pure electric vehicle owners, the willingness of hybrid vehicle owners to build private charging piles is not very high. In addition, the main problems are that all charging piles are not charged smoothly, the utilization rate of charging piles is low, and it is difficult for private car owners to build charging piles with cars.

2. Thinking about the development of charging piles based on new infrastructure

(1) High reliability and long service life are the basic performance requirements for charging piles under the new infrastructure

The design life of infrastructure projects such as housing construction, highway, railway, airport, port and water conservancy in the traditional infrastructure "Iron Gong Ji" is usually 50 years. Because of the long design life, it can meet the late economic development needs on the premise of moderately ahead of construction and deployment. For charging infrastructure, the design life of charging pile products is usually about 10 ~ 15 years, and the warranty period is usually 1 year, which is far from the design life of traditional infrastructure of 50 years, and it is difficult to meet the rigid requirements of high reliability and long life for infrastructure deployment in advance under the new infrastructure situation.

The service life of charging pile is related to many factors, which are closely related to the overall design and material selection of the product itself; It is also closely related to the use environment and operation specifications of products. The design of charging pile system needs to meet the power requirements of different charging stages and models. It is necessary to have high flexibility in product design. The power allocation of single pile should not be too high in the current layout stage, and the capacity of single pile can be increased by simple measures in the later expansion stage.

(2) Grid coordination and bidirectional are the dispatching function requirements of smart grid for charging piles

Since the concept of smart grid was put forward, it has been developed and applied in different countries. China has carried out relevant technical research and engineering demonstration through several demonstration projects. In the field of power distribution, intelligent terminal equipment and intelligent instruments are the basic key equipment to realize smart grid. As one of the core equipments in the field of power distribution, the charging pile must be organically integrated and coordinated with the power grid through information technology, sensor technology and automatic control technology, so that the charging pile has the dispatching ability and can realize two-way interaction with the power grid to provide power support for the power grid in an emergency.

(3) The combination of charging and storage and flexibility are the technical flexibility requirements of smart grid for charging piles

In urban distribution network, with the rapid increase of charging load, the difference between peak and valley is increasing day by day. If the capacity increase of distribution network is adopted completely, it will face the thorny problems of high investment risk and low equipment utilization rate. Even if the orderly charging technology is adopted, it is difficult to achieve the best effect due to many factors such as user habits, price elasticity coefficient and time window. In order to delay the capacity increase of equipment, the energy storage system can be combined with charging piles to improve the flexibility of charging facilities, reduce the peak power demand of the power grid and realize the flexible connection of charging piles to the power grid.

(4) Non-inductive charging and humanization are the interactive experience requirements of charging users for charging piles

Different from traditional electrical equipment and refueling gun, charging pile, as a kind of electrical equipment frequently operated independently by users in the era of new energy vehicles, should not only fully consider its safety and reliability, but also establish an experience relationship with users in the intelligent era. The charging pile series products currently used in China are mostly the product design ideas in the traditional industrial era, which have insufficient consideration for the user experience, and generally have problems such as complex operation, non-intuitive information, poor interactive experience, etc., which cannot meet the user's high-frequency interactive experience needs in future scenes.

In future scenarios, charging piles will become electrical equipment with high frequency operation, whether it is centralized charging stations or decentralized charging facilities. It is necessary to update the design concept, realize non-inductive charging, and enhance the humanized characteristics of charging facilities.

3. Suggestions for the future development of charging piles

The new infrastructure has brought a good strategic opportunity to the development of charging pile industry. Grasping the historical opportunity, leading the industry reform and promoting industrial progress will surely promote the leap-forward development of China's charging pile industry. Combined with the development status of the industry and the problems encountered, the following suggestions are put forward:

(1) Put the safety of charging piles at the top of the list. Only by controlling the safety risks to a minimum can the long-term development of the industry be better promoted.

(2) The whole industry needs to make it clear that charging piles are the infrastructure to serve electric vehicles, and it is necessary to strengthen the technical exchanges between vehicle enterprises and pile enterprises, increase the charging matching test of vehicle piles, continuously optimize the charging experience of vehicle owners, deepen the data interaction of vehicle piles during charging, and promote the market cooperation between the two sides after automobile sales.

(3) Charging operators should pay more attention to the overall performance of public charging piles and improve the overall level of charging services. Operators should strengthen interconnection and intercommunication to solve the problems of difficulty in finding piles, poor charging experience and low utilization rate of charging piles.

(4) Promote industrial standardization, especially the standardization of charging pile products, and collect opinions from all parties in the industry, especially pay close attention to the opinions of car companies.

(5) Focus on the construction of charging piles in the community, and relevant parties should jointly promote the construction of charging piles in the community through various channels. Promote the sharing of private piles and promote the orderly allocation of capacitance in the community. (Source: Energy Research Club Author: Tong Zongqi)

LATEST NEWS

- Xi Jinping sent a congratulatory letter to the 2019 World New Energy Vehicle Conference 2020-11-24 17:42:36

- Prospect of charging pile construction under new infrastructure 2020-11-24 17:40:17

- "Replacement" of Electric Speed-up Charging Pile 2020-11-24 17:27:20

- Why is the future charging pile market of new energy vehicles predicted to be a "bull market"? 2020-11-24 17:21:50

- Promote the construction of charging pile facilities "three axes" 2020-11-24 17:18:05

- To activate the rural new energy automobile market, we must solve the "mileage anxiety" 2020-11-24 17:14:00

Hangzhou guokong electric power technology co., ltd Service hotline: 0571-81969856 / 0571-87973887Company address: 3/F, Building 1, Qianjiang Pentium Science and Technology Park, No.16 Xiyuan First Road, Xihu District, Hangzhou